Initial condition

When employees are absent for the reasons like illness, accident, military service, etc., wage-replacement benefits are normally provided by third parties (insurance companies) in the form of daily allowances.

If the employer pays the "usual" wage during the absence, wage-replacement benefits are to be accounted for in the payroll.

If wage-replacement benefits are not subject to accounting in case of social insurance, the deduction base for contributions reduces so that these wage-replacement benefits and the net wage are therefore higher than if no such benefit had been processed.

Guidelines for net pay correction (NP Compensation)

❑The employer is obligated to carry out daily allowance adjustments

❑The higher net wage after an absence meets with incomprehension

❑Therefore, there is a possibility to carry out a net wage compensation, provided that it complies with labor legislation (collective employment agreement, individual employment agreement, OG, etc.)

❑For this reason, the wage processing software permits daily allowance adjustments with or without net wage compensation

Source: Guidelines for Wage Data Processing 20091204, December 18, 2009 edition – swissdec

Starting from Update 5050.000, SwissSalary calculates net pay correction automatically using an iteration. First, the net wage is calculated without daily allowance adjustments. After the acquisition of daily allowance adjustments, social security and income tax bases are upscaled and downscaled +/- until the net wage is back to 1:1, the same as without daily allowance adjustment.

Please be sure to follow the instructions of swissdec that net pay correction may only be used under the conditions described above. The process of net pay correction has neither particular juridical basis, nor detailed professional manuals. It is important that net pay correction is implemented not only for individual employees, but also for a clearly defined group (GAV) or for the whole company. If you want to manage company personnel with and without net pay correction, you have to duplicate the corresponding daily allowance salary types (with/without NP compensation).

Settings

It is very easy to set up net pay correction in SwissSalary.

New salary type net pay correction

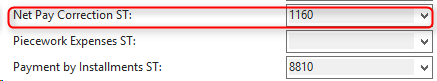

First of all, you need a new salary type Net pay correction. It can be a copy of the Monthly Wage or Monthly Wage Correction salary types. Copy one of these salary types and assign number 1160 (default payroll master data) to the new wage type. Please note that the calculation type is set to negative. Edit the translations. As a rule, obligations and account assignments remain as in the output wage type Monthly Wage.

The new wage type assignment in the Payroll Master Data

In order that SwissSalary detects which wage type is responsible for net wage compensation, you will need to record this new wage type once in the payroll master data in tab Base -> field Net Wage Compensation of the wage type.

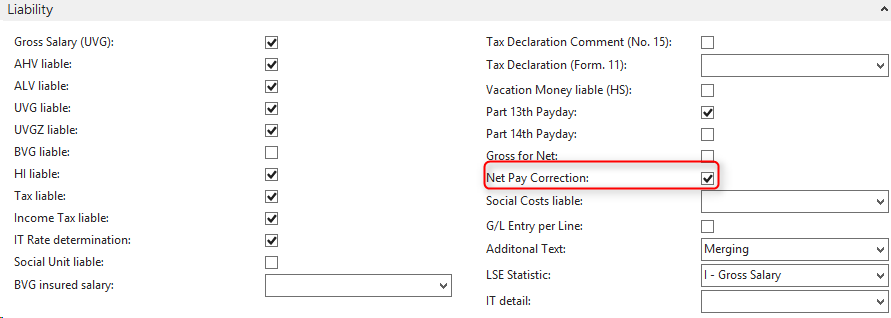

Marking daily allowance wage types

Now you have to set the checkmark in the Net Wage Compensation field for Daily Allowance Adjustment and the corresponding Daily Allowance wage type. Again, we would like to point out that need to duplicate the daily allowances wage types, as long as you have different considerations in the same client (with/without NW compensation).

Net wage compensation calculation

You are ready for the calculation of net wage compensation now. SwissSalary calculates the compensation in a usual billing process automatically. Despite greater computing power required for iteration, we could not determine in our tests any noticeable loss of performance during the process of wage accounting.

How can the calculation be controlled?

Create a test billing for employees without daily allowance adjustments. Note down the net wage amount. Finally, record the daily allowance adjustment and create a test billing again. Now, wage type 1160 will be displayed automatically in the area of Gross Wage with a minus amount. The net amount of wages again should be the same as without daily allowance adjustment.

Our calculation is carried out by means of iteration of social and private insurance bases, and the withholding tax base. The bases along with the exemption of daily allowance adjustments are additionally eliminated again by means of wage adjustment. Of course, this calculation equally applies both to the employer and the employee. With this additional wage cut and the associated reduction of wage bases, the employee receives the same net wage as if he had received no daily allowances. Through this additional discharge of wage bases the net wage compensation in case of some social security funds is not entirely noncontroversial. Important insurance contributions to social insurance companies are avoided, and additional reduction in the employee's social security base can lead to the situation when, for example, s/he is no longer sufficiently covered by the AHV insurance and therefore must register as an inactive person.

Our support has been instructed not to provide legal information to customers and/or partners, whether net wage compensation should be carried out in particular cases. Individual companies must settle it themselves. Since there is no legal basis for net wage compensation, it may lead to refunds and back payments in case of dispute (no legal protection of the employer against employees stipulated in agreements). Of course, if you have questions about calculation logic, we will provide you with necessary information.