For the insured earnings to be calculated, relevant categories must be assigned in the Absences tab to all wage types subject to UVG that are required for reporting to accident insurance company of KTG insurer. => see Accident Details

The composition of insured earnings can vary from insurer to insurer for a specific event and also de-pending on the configuration. This means that the insurer has ultimate control over the amount of insured earnings. In case of any ambiguity during wage types setup, the customer must contact the insurer them-self. Therefore, no daily allowance is calculated with KLE, but the insurer is provided with the basis for calculating the insured earnings. Current and/or past wage components are taken into account. This basis for calculating the insured earnings is either used by the insurer directly to calculate daily allowance or they can determine the insured earnings relevant for calculating daily allowance using the data received. => KLE Guidelines - Swissdec www.swissdec.ch CH Service Standard Guidelines (KLE)

A filter for salary types subject to UVG can be used to quickly display all salary types, which may have to be set up accordingly.

Attention: Family allowances are also part of the insured earnings.

The sums of wage types are combined in different wage bases due to their character.

=> open salary types, use Personalize to insert fields Accident details, Accident insured earnings and KLE salary type of working hours lost due to accident.

The salary types can be quickly filled in via Manage - Edit list.

Demage Detail

Possible selection fields in the Accident details field:

Damage insured salary

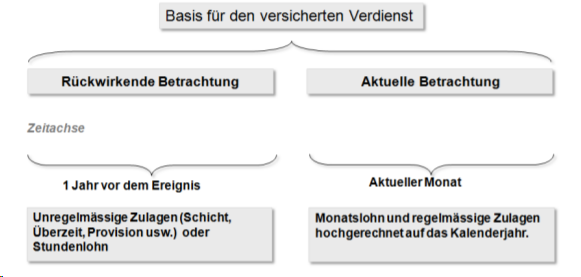

There are two different ways of considering wage types: expected (also called current) and retrospective.

An example with current consideration of salary types (expected, regularly recurring wage components)

Current consideration relates to the part of the income that a person earns immediately before the event. It applies to all persons receiving monthly salary. This means that SwissSalary takes wage data from the month of the event. Depending on the information stored in the refunding of absences, the required wage types are multiplied by 12 or 13 and totaled.

An example with retrospective consideration of wage types (irregular wage components)

SwissSalary calculates 12 months backwards from the month before the event occurred. For a shorter period (employment <12 months), SwissSalary will make a 365-day offset.

Beware of wage increases that have not yet been posted at the time of reporting. They are not taken into account. Entries in the ‘Timemachine’ are currently not recognized either. Child allowances not yet been paid because the allowance notification has not yet been received will not be taken into account if they are set to inactive. => see Chapter Special cases - Manual additional payments

KLE salarye type of working hours lost due to accident

Working hours lost are individual absences of a person at least partially able to work related to the insured event (e.g., doctor appointment, physiotherapy). Working hours lost can be reported in Hours with an additional wage type, e.g. Paid absence or Paid brief absence. The box below must be checked for this wage type:

Exact information about reporting working hours lost => Special cases - Working hours lost