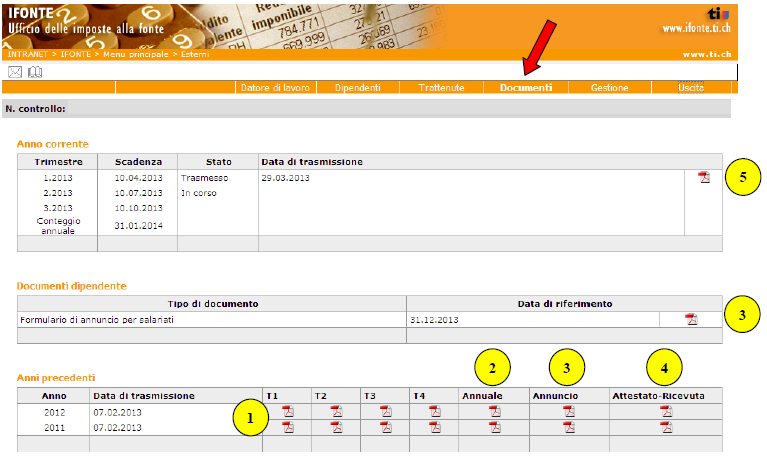

1st quarterly calculations of previous years

2. Annual calculations of previous years

3. Registration forms (do not need to be created)

4. Acknowledgment of receipt for employees

5. Quarterly/annual calculations of the current financial year (repayment is understood to mean the submission of the withholding tax quarterly calculation, which must be made no later than 10 days after the following dates: 31.03, 30.06, 30.09).