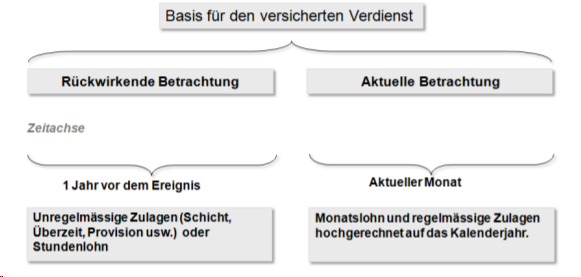

There are two different ways of considering wage types: expected (also called current) and retrospective.

An example with current consideration of salary types (expected, regularly recurring wage components)

Current consideration relates to the part of the income that a person earns immediately before the event. It applies to all persons receiving monthly salary. This means that SwissSalary takes wage data from the month of the event. Depending on the information stored in the refunding of absences, the required wage types are multiplied by 12 or 13 and totaled.

An example with retrospective consideration of wage types (irregular wage components)

SwissSalary calculates 12 months backwards from the month before the event occurred. For a shorter period (employment <12 months), SwissSalary will make a 365-day offset.

Beware of wage increases that have not yet been posted at the time of reporting. They are not taken into account. Entries in the ‘Timemachine’ are currently not recognized either. Child allowances not yet been paid because the allowance notification has not yet been received will not be taken into account if they are set to inactive. => see Chapter Special cases - Manual additional payments