Task #4075, Task #7667, Task #7668, Task #7669, Task #7671, Task #7672 & Task #7723 | 5050.200

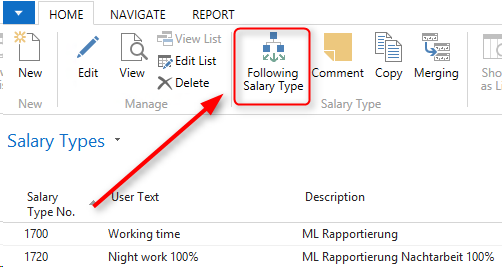

The resulting salary types can no longer be found in the wage card “Function” tab. Instead, they are now directly located in the ribbon (RTC Client) or can be opened via the “Salary Type” button in Classic clients. This has the advantage that you can define several resulting salary types with a variety of options for each wage type. You can now define premiums and weekdays of their calculation. The resulting wage types can be opened with the help of “Ctrl+G” key combination.

Example:

A premium of 25% is due on Saturday and of 50% is due on Sunday. Until now, 2 more salary types with appropriate premiums needed to be created besides working hours report ST (Saturdays and Sundays). From now on, you only need ST 1700 MW Reporting (working hours) and salary types for surcharges (per weekday) in “Following Salary Types”.

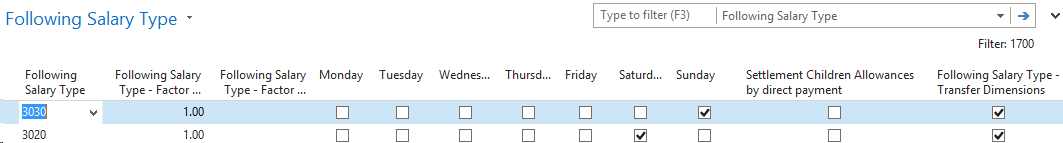

In the “Following Types” table additional following wage types with different surcharges per weekday can be defined:

The following columns are displayed (by default):

Following Salary Type |

Recording of the resulting wage type number |

Following Salary Type – Factor Quantity |

Recording of the factor for the resulting wage type in the “Number” field Example: Payout of 100 overtime hours plus the resulting wage type premium of 25%. The resulting wage type already contains 0.25 as the Factor. Thereby, 100 hours will be transferred from the output wage type to the resulting wage type at 1:1. |

Following Salary Type - Factor Amount |

Recording of the factor for the resulting wage type in the “Amount” field Example: Daily allowance adjustment WT should catch up the daily allowance WT. After the recording of daily allowance amount, the same amount will be transferred at 1:1 to the “Amount” field of the resulting wage type. |

Weekdays (Monday – Sunday) |

Based on the document date (TapBoard/Report Journal), it is checked which resulting salary type is pulled for premium calculation. The calculation can only be made if, for example, working hours can be accurately detected to the day.

|

Settlement Children Allowances by direct payment |

In the cantons of GE and VS, family allowances are directly paid to employees in part. For amount offsetting for a WT wage bill, family allowance must also be calculated, though set off with a compensation wage type right away. In case of the resulting wage type (settlement), a check mark must be set here. |

Following Salary Type – Transfer Dimension |

By setting the check mark, the recorded dimension (CC/CB) on the output wage type is automatically transferred to the resulting wage type. |

The following columns can be displayed additionally:

Following Salary Type – Factor Rate |

Recording of the factor for the resulting wage type in the “Rate” field (rarely used; recording of the output value is usually done under “Number” or “Amount”) |

Following Salary Type – Suggestion Line |

If more than one resulting salary type are rowed together, then the calculation is done to the last wage. A break in the calculation process can be made by setting a check mark. E.g., the calculation will stop at the second resulting wage type and you can enter a different number or a different amount. After that the calculation will continue. |

Day Types |

If employees work on holidays, usually premiums also apply like on Saturdays or Sundays. You can add the “Day type” for holidays to the row with the premium. Based on the transaction, the system will then automatically detect that the same premium must also be paid for a holiday. The day types can only be used in SwissSalary Plus, provided that working time calendar is use. |

The old resulting wage types are incorporated into the new structure automatically via the automatic “Update process”. If the wage type masters are linked across clients, the resulting wage types are also incorporated accordingly.

Using the “Function” selection option, the “Wage Type List” report also shows the resulting wage type unless it has several of them. Then, the following message appears: “There are x resulting wage types”.