Task #7253 | 5050.100

In rare cases, BVG limit amounts (lower/upper limit, minimum wage and coordination) are not to be calculated based on monthly limits, but on an hourly basis for hourly wage. For this purpose, the BVG settings have been expanded and revised as follows:

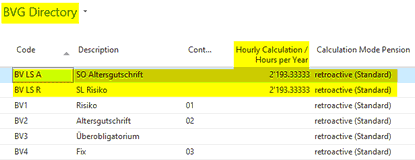

❑New field "Hourly Calculation / Hours per Year" | Input field for hours per year

❑Panning of the "BVG Calculation Mode" field on the line | Parameterization per insurance solution made possible (not overall)

The calculation type is only provided for the "effective" calculation (fictitious annual salary calculation is not taken into account). The value for an employee in the BVG tab of the Personnel card must be set to "actual". Thus, the accounted salary types with check marks set in the "Subject to BVG" and time types assigned are taken into account. This way, we additionally recognize the hourly wage types that are to be considered.

Salary type = Subject to BVG + Available time type | Wage type is taken into account for the calculation of BVG limits

Example with 2'193.33 hours a year

Upper limit | CHF 84'600 / 2,193.33 = Hourly basis upper limit | CHF 38.57

Lower limit | CHF 84'600 / 2,193.33 = Hourly basis lower limit | CHF 9.64

etc.

This means that an employee with an hourly wage < CHF 9.64 is not considered in the BVG.

With this calculation type no compensation could be partly contributed over the year. For this reason, the existing field "BVG Calculation Mode" has now been transferred to the line and can be flexibly re-defined for each calculation.