Selection fields:

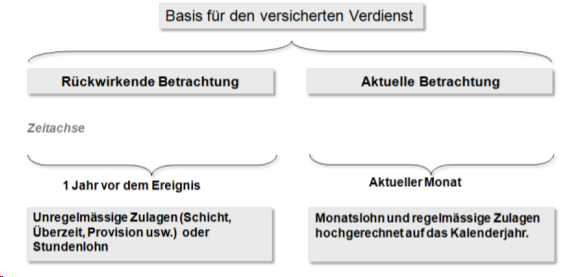

•presumably (also currently referred to as)

•retroactively

Example with current consideration of salary types

Applies to all employees paid monthly:

SwissSalary acquires wage data from the current month. Depending on the information stored in the refunding of absences, the required salary types are multiplied by 12 or 13 (13 for the 13th MW) and totaled; all other wage items (x 12 or x 13 in compliance with the 13th MW obligation) are added.

Example with retrospective consideration of salary types

SwissSalary calculates 12 months (months entered in the books) from the current month backwards. For a shorter period (employment <12 months), a 365-day offset is made.

Note: Pay rises not yet posted at the time of reporting are not taken into account (including TimeMachine entries). Child allowances not yet been paid because the allowance notification has not yet been received will not be taken into account if they are set to inactive.